Financial Inclusion in India

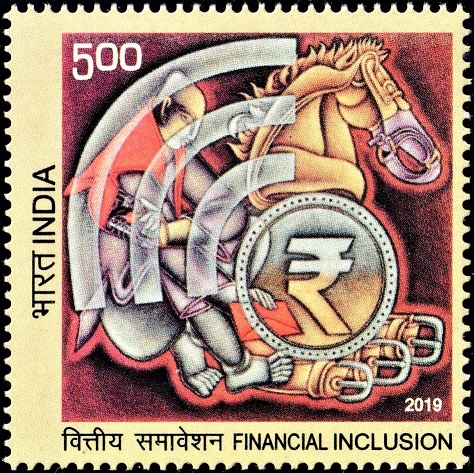

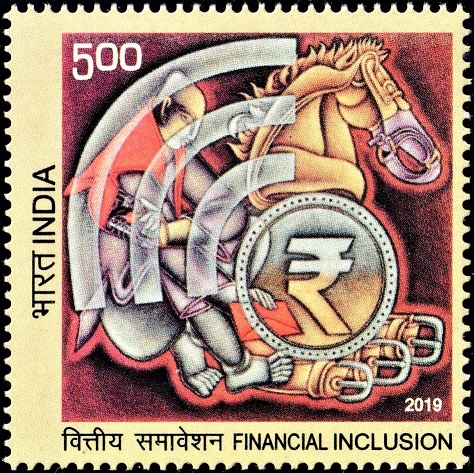

A commemorative postage stamp on the Indian Financial inclusion :

Issued by India

Issued by India

Issued on Jan 30, 2019

Issued for : Department of Posts is pleased to issue a Commemorative Postage Stamp on Financial Inclusion.

Credits :

Stamp : Shri Satish Gujral

FDC/Brochure : Shri Kamleshwar Singh

Cancellation Cachet : Smt. Alka Sharma

Type : Stamp, Mint Condition

Colour : Multi Colour

Denomination : 500 Paise

Stamps Printed : 5.0 Lakh

Printing Process : Wet Offset

Printer : Security Printing Press, Hyderabad

About :

- Provision of access to financial services to low-income households and small businesses has been a long standing goal of Government of India. The ‘Committee on Comprehensive Financial Services for Small Businesses and Low Income Households’ had observed that on aspects of both Financial Inclusion and Financial Depth, the overall situation was very poor and, on a regional and sectoral basis, very uneven. Financial Inclusion is defined as the spread of financial institutions and financial services across the country while Financial Depth is defined as the percentage of credit to GDP at various levels of the economy. Majority of small businesses have no links with formal financial institutions and close to half of the rural and urban population do not even have a functional bank account. There is high demand for a wide range of financial services by small businesses and low-income households combined with a willingness to pay for them. The challenge is clearly the ability of the formal financial system to mount a strong supply response, which needs to be strengthened considerably. It is in this context that the role of Post Office towards Financial Inclusion needs to be understood.

- The Post Office Savings Bank (POSB) founded in 1873 to promote thrift and savings, much before commercial banks made their appearance, is the sheet anchor of financial inclusion in India. With a spread across 155,000 Post Offices it has been rendering yeoman service to the nation.

- On 15 August, 2016 the Prime Minister announced the setting up of India Post Payments Bank (IPPB) during his 70th Independence Day address to the nation from the Red Fort. The subsequent incorporation of the bank, grant of the final license by the Reserve Bank of India and launch of two pilot branches on 30 January, 2017 have brought to fruition the long standing quest of the Post Office to contribute its might to the formal banking sector.

- IPPB is committed to achieving the objective of financial inclusion in India. The motto of the bank, ‘Aapka Bank Aapke Dwar’ will translate into more than three lakh Postmen and Gramin Dak Sewaks providing assisted banking at door steps in rural, urban and remote areas particularly to those not familiar with technology such as the rural poor and the elderly. The bank is focussing on equipping and enabling small merchants and vendors to accept cashless payments and thereby foster a digital acceptance ecosystem. IPPB is creating infrastructure at the last mile to strengthen and deepen DBT. The association with India Post and the Dakiya infuses trust and confidence amongst users to try out electronic banking, including UPI. IPPB will make banking and payments simple. Using technology, it simplifies opening of accounts in minutes and allows customers to make digital transactions with the help of QR Cards and biometric authentication. The bank also runs financial literacy programmes to teach electronic banking to those not comfortable with information technology based applications including homemakers, farmers and workers. IPPB enables the post office to accept digital payments at counters, offer small savings schemes online (NSC/KVP/PPF) and increase its footprint in the e-commerce world by providing electronic cash on delivery options to its customers at their door step.

- In perspective, the IPPB is a seminal part of the objective of the Government of India to promote financial inclusion of the weakest and least accessed segments of the country. It is a critical building block of the Government of India’s financial inclusion strategy.

- Since the nationwide launch of IPPB by the Prime Minister on 1st September, 2018 the bank has expanded its network from 350 branches and 3250 access points to 1,19,640 access points as on 14-01-2019. In the process, the banking network of the country has doubled while the bank network has increased by 2.5 times.

- Text : Based on the information received from PBI Division, Department of Posts.

Subscribe

Login

0 Comments

Oldest