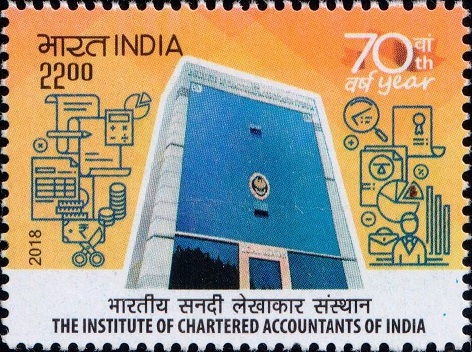

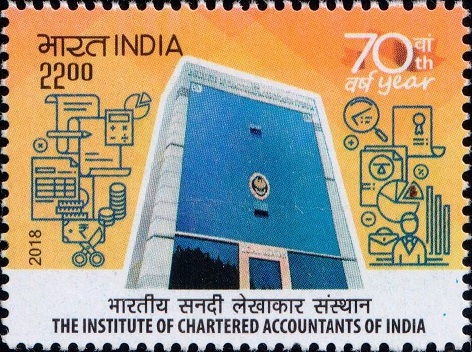

The Institute of Chartered Accountants of India

A commemorative postage stamp on the Institute of Chartered Accountants of India (ICAI), national professional accounting body of India :

Issued by India

Issued by India

Issued on Jul 1, 2018

Issued for : Department of Posts is pleased to issue a Commemorative Postage Stamp on The Institute of Chartered Accountants of India.

Credits :

Stamp/FDC/Brochure : Sh. Kamleshwar Singh

Cancellation Cachet : Smt. Alka Sharma

Type : Stamp, Mint Condition

Colour : Multi Colour

Denomination : 2200 Paise

Stamps Printed : 6.0 lakh

Printing Process : Wet Offset

Printer : Security Printing Press, Hyderabad

About :

- The Institute of Chartered Accountants of India (ICAI) is a statutory body established by the Chartered Accountants Act, 1949 for regulating the profession of Chartered Accountants in the country. It is noteworthy that the Act came into force from 1st July, 1949 even before the Constitution was adopted by India. The creation of the Institute was a very important step in the progress of the profession. The Indian legislature placed a great responsibility on the Council of ICAI expecting them to establish standards of professional efficiency and professional integrity.

- Since its inception in 1949, the ICAI has come a long way as an autonomous regulator of accounting and auditing profession in line with its role defined under the Act. It has been in the forefront of propagating sound and resilient accounting and auditing practices. The role of ICAI as a National Standard Setter and as an educator has been the hallmark of its existence.

- Since 1949, the profession has grown by leaps and bounds in terms of membership and student base. Starting with a handful of about 1700 members, the strength of the Chartered Accountant fraternity today, has grown to over 2.70 lakh members. On the education front, the ICAI began with mere 259 students and today about 7.25 lakh active students are a part of ICAI.

- ICAI is the second largest accounting body in the world with a strong tradition of service to the Indian economy. It has achieved recognition as a premier accounting body for maintaining highest standards in technical as well as ethical areas and for sustaining stringent examination and education standards.

- The affairs of the ICAI are managed by a Council in accordance with the provisions of the Chartered Accountants Act, 1949 and the Chartered Accountants Regulations, 1988. The Council is composed of 40 members of whom 32 are elected by the members and remaining eight are nominated by the Central Government generally representing the Comptroller and Auditor General of India, Securities and Exchange Board of India, Ministry of Corporate Affairs, Ministry of Finance, Ministry of Commerce and other stakeholders.

- In terms of the Act of 1949, the President is the Chief Executive Authority of the Council. The Secretariat of the ICAI is headed by the Secretary who is in-charge of the office of the ICAI as its Executive Head. The activities of the ICAI can be broadly divided into regulatory, standard setting, disciplinary and education and training.

- The Institute functions under the administrative control of Ministry of Corporate Affairs, Government of India. It has its headquarters in New Delhi and 5 regional offices in Chennai, Kanpur, Kolkata, Mumbai and New Delhi. It presently has 163 branches spread all over the country. In addition, it has also set up 31 chapters outside India and an overseas office in Dubai.

- The ICAI is often called upon by various regulatory / statutory authorities of India on issues related to the profession and otherwise. Several Departments of the Central and State Governments of India approach the ICAI for utilizing the services of Chartered Accountants for advice on economy in expenditure, development of control mechanism over public funds and optimum and effective cost of funds. Members of the ICAI contribute to public interest and national growth with the motto of Independence, Integrity and Excellence.

- Text : Based on information received from proponent.

Subscribe

Login

0 Comments

Oldest